What is our financial position?

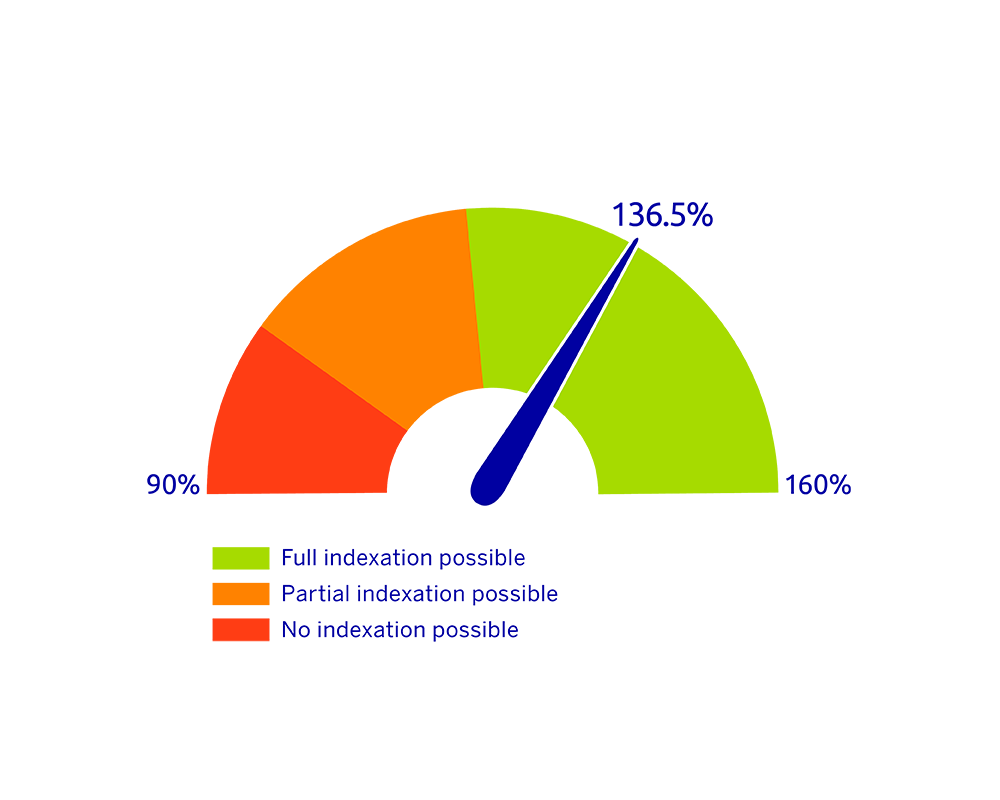

The policy funding ratio (average current funding ratio over the past 12 months) at the end of December 2025 is 136.5%. The current coverage ratio at the end of December 2025 is 135.4%.

Read moreWhat does this mean for your pension?

As of January 1, 2026, we increased the pensions of retirees and deferred pensioners under the final salary scheme by an indexation of 2.46%.

Every year in November, the Mars Pension Fund decides on the indexation based on the price index and the policy funding ratio in September of that year. You can read more about the indexation decision here.

Read moreWant to know more about how our fund invests? Follow our blog series.

Funding ratio

The funding ratio of a pension fund indicates the ratio between its assets and liabilities, and is an indicator of the financial position of a pension fund.

Frequently asked questions

With a policy coverage ratio of around 123%, we have sufficient financial buffers to allow pensions to grow fully in line with price increases (indexation).

The amount of your pension may still change. For example, by increasing it (indexation) or decreasing it (reduction). Whether your pension is increased or decreased depends on the financial position of the pension fund. If the financial situation does not meet the requirements for a longer period of time, the chance of indexation becomes small and the chance of reductions larger. You can find more information here.

A pension fund must have buffers, because the future is uncertain. In this way, we ensure that we can pay out pensions to everyone even in the event of financial setbacks.

Click here to learn more about your pension fund's financial position.