Notes on the financial position in December 2025

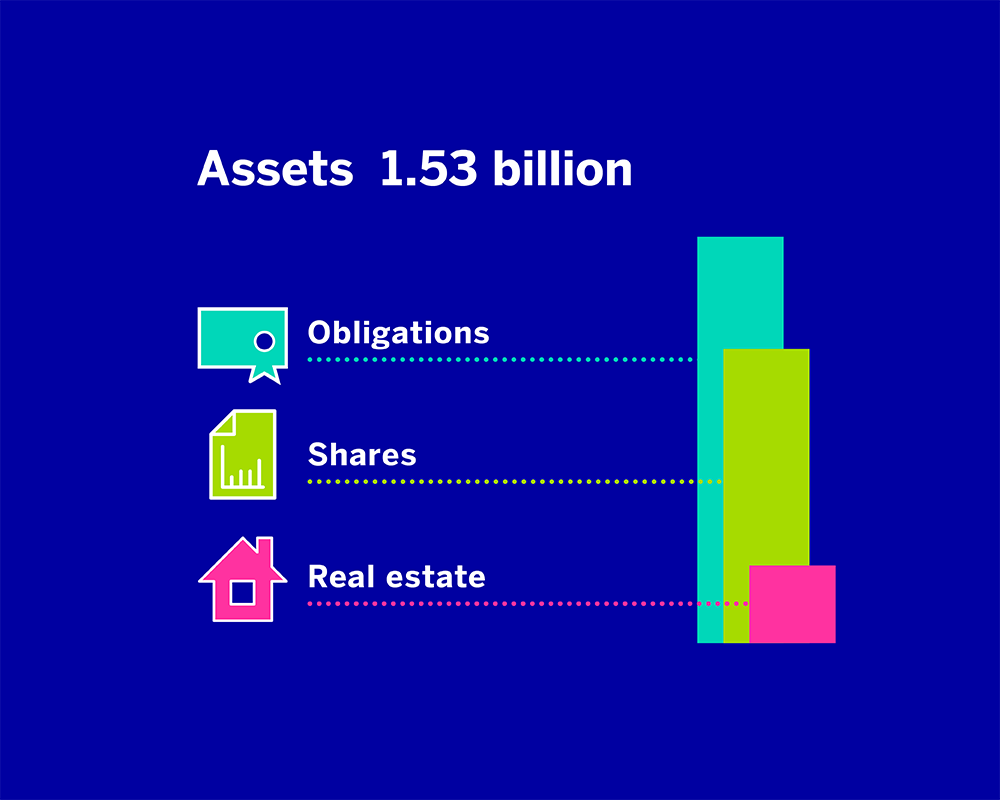

Assets: our assets are €1.53 billion.

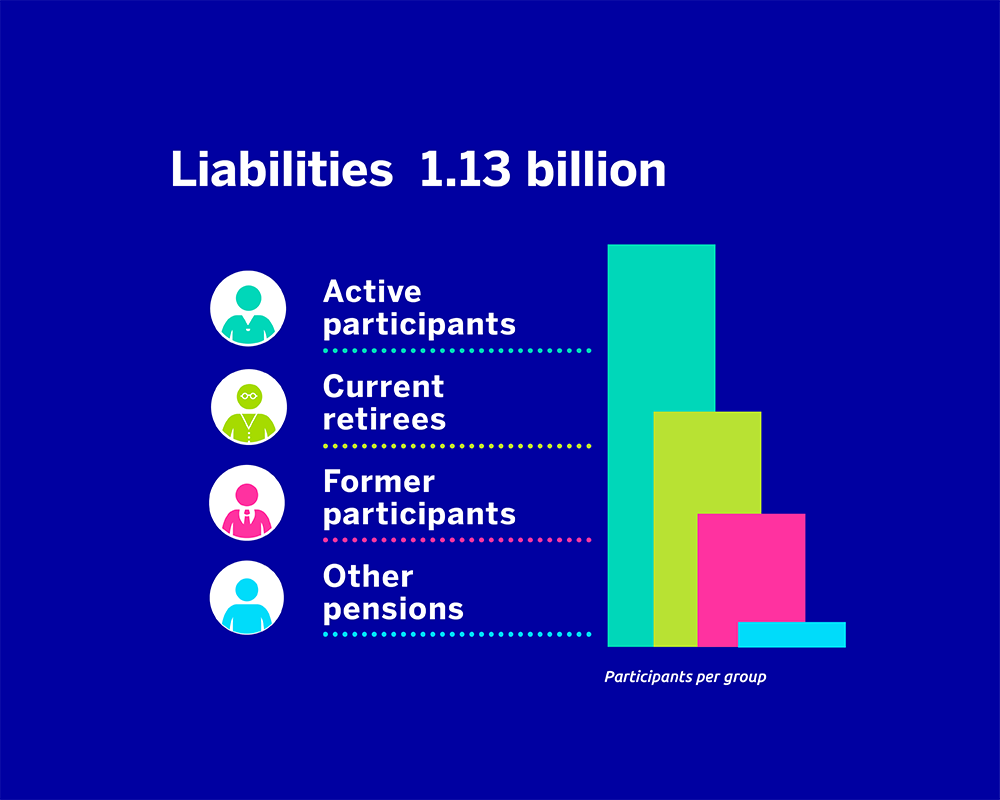

Liabilities: the money we must have to pay all pensions (now and in the future) is € 1.13 billion.

Actual funding ratio: The funding ratio is the ratio of assets to liabilities. The actual funding ratio is 135.4%.

Policy funding ratio: The policy funding ratio is the average funding ratio over the last 12 months. The policy funding ratio is also 136.5%.

Compulsory additional buffer

If the capital is as large as the liabilities, in other words if there is just enough money to pay all pensions now and in the future, then the funding ratio is 100%. This seems good enough, but it is not. A pension fund must have a buffer, because the future is uncertain. In this way we ensure that we can pay out pensions to everyone even if there are financial setbacks. The buffer is determined on the basis of government rules and can vary as a result of how risky the investments are and how high the interest is.

How big does the buffer have to be?

According to government rules, our assets must be 20.1% (November 2025) more than our liabilities. So we must have enough money to pay pensions now and in the future, plus a buffer of 20.1%. This will enable us to cope well with any unexpected decline in assets. Currently, the policy funding ratio of 136.5% (December 2025) is above the required level. The pension fund therefore has sufficient financial buffers.

Frequently asked questions

A pension fund must have buffers, because the future is uncertain. In this way, we ensure that we can pay out pensions to everyone even in the event of financial setbacks.

We try to make your pension grow along with a portion of the increase in prices each year. This is called indexation. This is only possible if the financial situation is good enough. Depending on the pension fund's financial situation, the Board decides every year whether a full, a partial or no indexation can be granted.