Investing in index funds

When investing your premiums, we use what are called 'index-related funds'. We also call these 'index funds'.

With an index fund, the investment strategy is to track the return of a specific index or benchmark. An index is a group of stocks whose overall return is used as a yardstick to measure the return of a particular market.

Risks of investing for your ASP pension

These risks are entirely for your own account. The returns on investments can always fluctuate in the interim. The final yield is also not fixed. View the risks of investing for your MSP pension here.

Read more

We pay fees for investments in the ASP plan. We also receive part of these costs back afterwards.

Since 1 January 2020, you pay administration costs as a participant in the ASP plan. In 2025, these costs are periodically € 58.86 per year if you are employed by Mars. Are you no longer working at Mars? Then these periodic costs are lower, namely € 28.96 per year. The Board determines the costs annually. There is a maximum. The costs will never be more than 1% per year of your total ASP capital. And new participants do not have to pay for the first three years.

The administration fee for the ASP is deducted from the value of your ASP account. You will find these amounts in your investment statement. This can be found in MyMarsPension.

As a member, you currently pay no buying or selling costs for Mars Pension Fund.

In the ASP plan, you accrue capital in your ASP account. You choose how this capital is invested. You have several options:

- Life Cycles: The Mars Pension Fund arranges for your contributions to be invested. You can choose from two Life Cycles: 1) Fixed Life Cycle and 2) Variable Life Cycle. Until you reach 58 years of age, the Fixed and Variable Life Cycles are the same. After reaching this age, the Life Cycles are different.

With ‘Life Cycle-beleggen’, the composition of investments is automatically adjusted to reduce risks as your retirement date approaches. The Fixed Life Cycle and the Variable Life Cycle are designed to combine well with the ASP account.

- Self-directed investing: with Self-directed investing, you yourself decide how your contributions are invested. You can choose from the investment funds selected by the Mars Pension Fund (see below).

Mars Pension Fund believes it is important that everyone has the opportunity to decide for themselves how premiums are invested. To check whether this method suits you, you have to go through the risk guide (risicowijzer) beforehand.

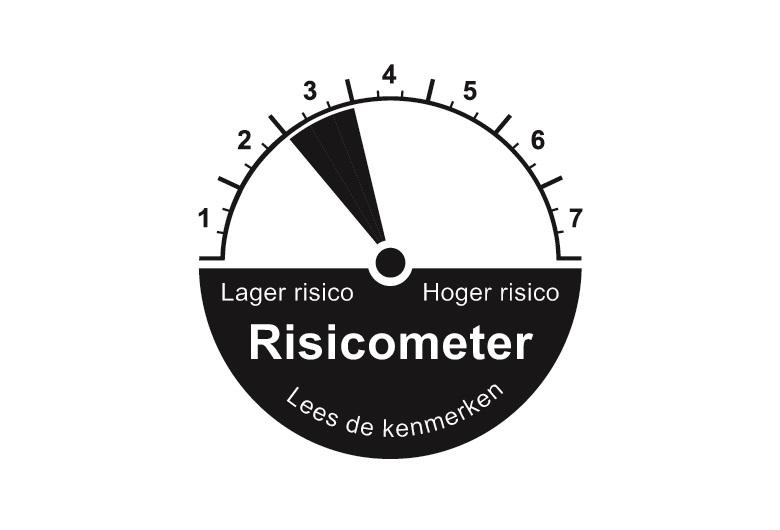

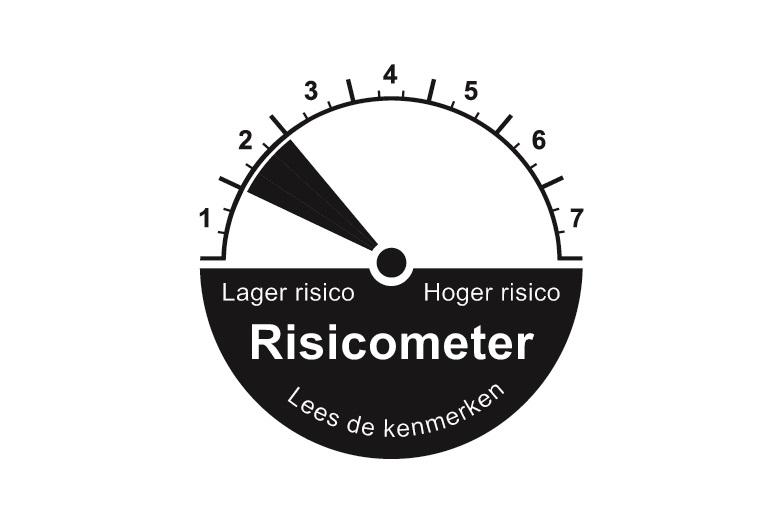

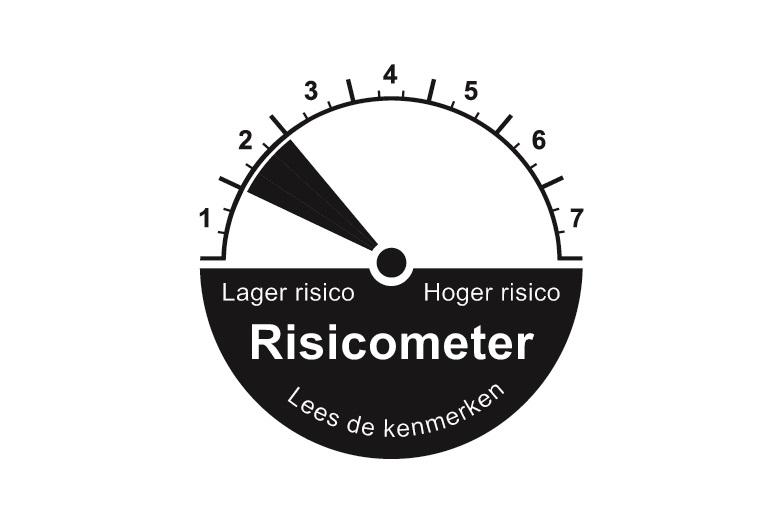

The risk meter indicates the risk of investments. These assessments have been determined by the Dutch Authority for the Financial Markets (AFM) and are based on the 'volatility' of the return of a share.

The more stable a share, the lower the volatility and the lower the risk profile. A higher risk profile is associated with higher volatility, and therefore a greater chance of higher, but also lower returns.

1. Global Stock Index Fund

ISIN: IE00B03HD316

- Region: Developed Markets Global

- Objectives:

- The fund seeks to track the performance of the MSCI World Index.

- This Index is comprised of large and mid-sized company stocks.

- The following risk profile applies to this fund.

2. Emerging Markets Stock Index Fund

ISIN: IE0031786142

- Region: Emerging markets worldwide

- Objectives:

- The fund seeks to track the performance of the MSCI Emerging Markets Index.

- This index is comprised of large and mid-sized company stocks.

- The following risk profile applies to this fund.

3. European Stock Index Fund

ISIN: IE0007987690

- Region: Europe

- Objectives:

- The fund seeks to track the performance of the MSCI Europe Index.

- This index is comprised of large and mid-sized company stocks.

- The following risk profile applies to this fund.

4. US 500 Stock Index Fund

ISIN: IE0032126645

- Region: United States

- Objectives:

- The fund seeks to track the performance of the S&P 500 Index.

- This index is comprised of large and mid-sized company stocks.

- The following risk profile applies to this fund.

5. ESG Global Stock Index Fund

ISIN: IE00B5456744

- Region: Developed markets worldwide

- Objectives:

- The fund seeks to track the performance of the FTSE Developed All Cap Choice Index.

- This index is comprised of large and mid-size company stocks.

- The fund excludes companies if their behaviour or products have a negative impact on society and/or the environment. These include activities and products around adult entertainment, tobacco, fossil fuels and weapons, and companies that do not comply with labour rights, human rights, and environmental and anti-corruption standards.

- The following risk profile applies to this fund.

6. 20+ Year Euro Treasury Index Fund

ISIN: IE00B246KL88

- Region: Europe

- Objectives:

- The fund seeks to track the performance of the Bloomberg Euro Treasury 20+ Year Bond Index.

- This index reflects the total universe of eurozone government bonds with a maturity of at least 20 years and a high credit rating.

- The following risk profile applies to this fund.

7. Euro Government Bond Index Fund

ISIN: IE0007472115

- Region: Europe

- Objectives:

- The fund seeks to track the performance of the Bloomberg Euro Government Float Adjusted Bond Index.

- This index comprises of eurozone government bonds with a maturity of more than 1 year.

- The following risk profile applies to this fund.

8. Global Short-Term Bond Index Fund

ISIN: IE00BH65QP47

- Region: Worldwide

- Objectives:

- The fund seeks to track the performance of the Bloomberg Global Aggregate Ex US MBS 1-5 Year Float Adjusted and Scaled Index.

- This index comprises of governments, government-related institutions, corporate bonds and bonds with maturities between 1 and 5 years.

- The following risk profile applies to this fund.

9. Euro Investment Grade Bond Index Fund

ISIN: IE00B04FFJ44

- Region: Europe

- Objectives:

- The fund seeks to track the performance of the Bloomberg EUR Non-Government Float Adjusted Bond Index.

- This index comprises of bonds with a maturity of more than 1 year.

- The following risk profile applies to this fund.

10. Eurozone Inflation-Linked Bond Index Fund

ISIN: IE00B04GQR24

- Region: Europe

- Objectives:

- The fund seeks to track the performance of the Bloomberg Global Inflation-Linked: Eurozone - Euro CPI Index .

- This index comprises of eurozone government bonds with a maturity of more than 1 year.

- The following risk profile applies to this fund.